4.) What is the VIX index and can you trade it?

The VIX index is probably the most watched volatility indicator in the financial market. It was introduced by the CBOE (Chicago Board Options Exchange) in 1993 and it was based on the S&P100 back then.

Since 2003 it's been based on the S&P 500 and it estimates the expected 30-day volatility of the stock market by analyzing a wide range of S&P 500 (SPX) index options. If you are interested in more details about the VIX index you can find a lot of information directly on the CBOE website.

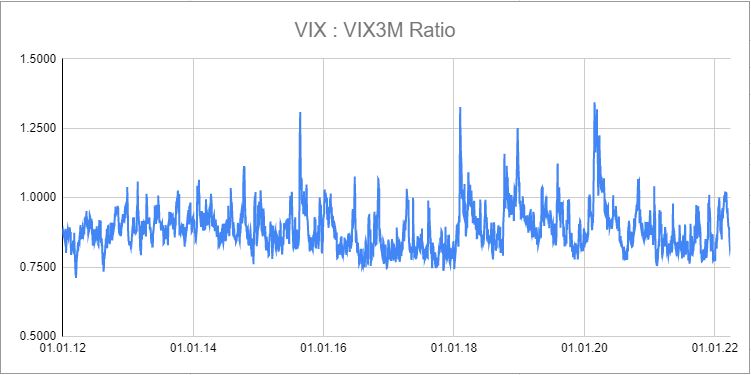

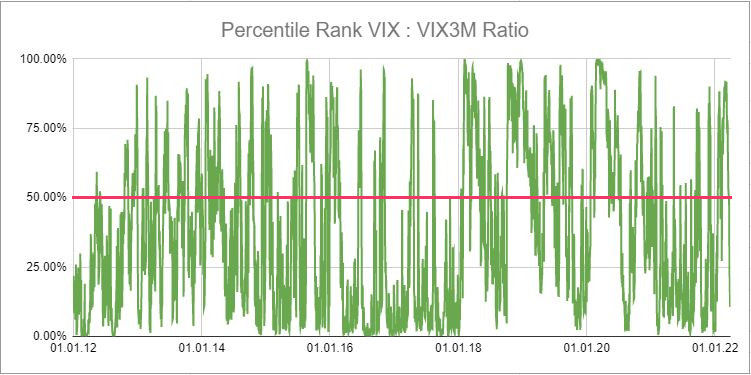

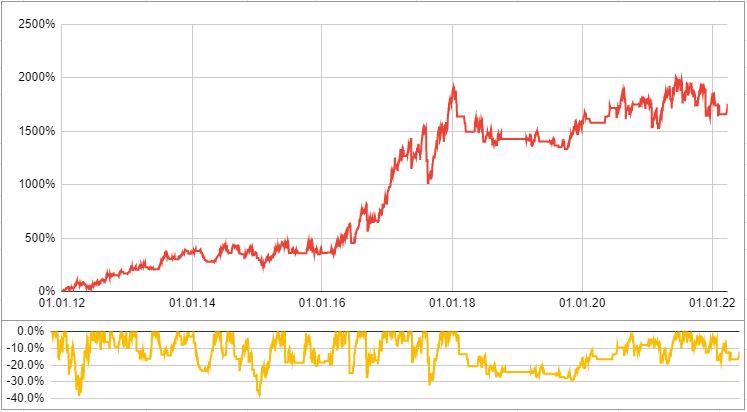

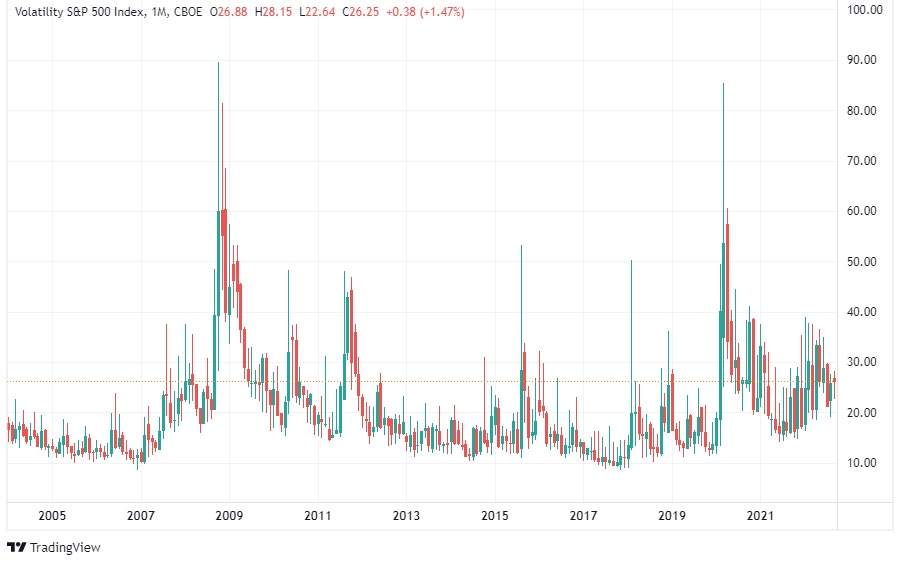

So let’s look at the chart of the VIX index from 2004 until 2022:

If you look at the VIX spikes in this chart you can easily detect some of the stock market crashes of the last 18 years:

- 24 Oct 2008 with a VIX of 89.53 (SPX drawdown of -45%)

- 24 Aug 2015 with a VIX of 53.29 (SPX drawdown of -12.5%)

- 06 Feb 2018 with a VIX of 50.30 (SPX drawdown of -9.8%)

- 18 Mar 2020 with a VIX of 85.47 (SPX drawdown of -32.8%)

While i am writing this in Sept 2022 we had in this year already a SPX drawdown of -24% but the VIX stayed always below 40 which is quite interesting: Compared to previous stock market crashes the option market participants (where the VIX index get it's values from) seems to not priced in the risks of this crisis.

And that brief digression already shows that the VIX index on it's own should not be used as a standalone "market indicator" to trade the stock market.

Can you trade the VIX index?

The VIX index itself (Ticker-symbol "VIX") can not be traded. But you can trade:

- VIX Options

- VIX Futures

- Volatility ETF (that hold different allocations of VIX Futures)

Both the VIX Options and Futures are available with different expiration cycles. And both are cash-settled since there is no possibility of physical delivery.

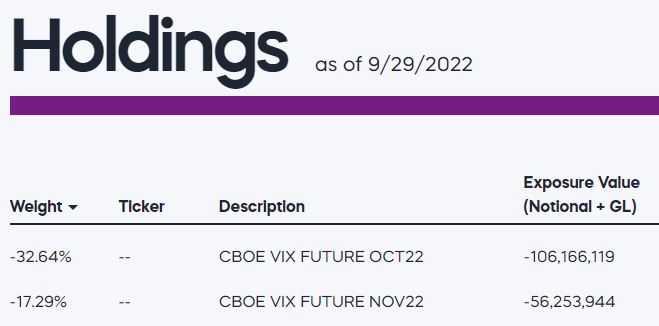

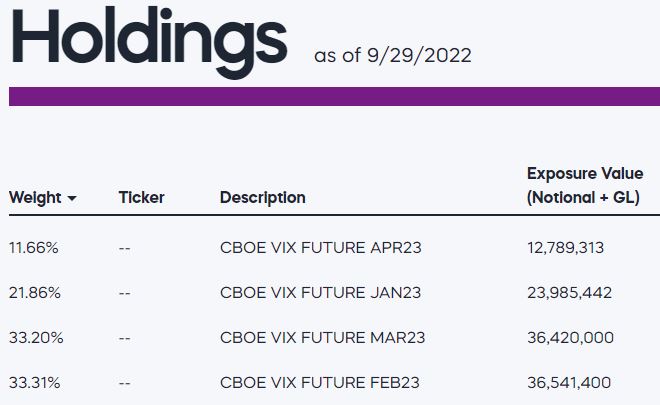

If we look at the Volatility ETFs solutions they can differentiate between:

- "short term" vs. "mid-term" VIX Futures

- "short" vs. "long" versions

- different leverages (0.5x / 1x / 1.5x / 2x)

In the next section you can find a list of different Volatility ETF.